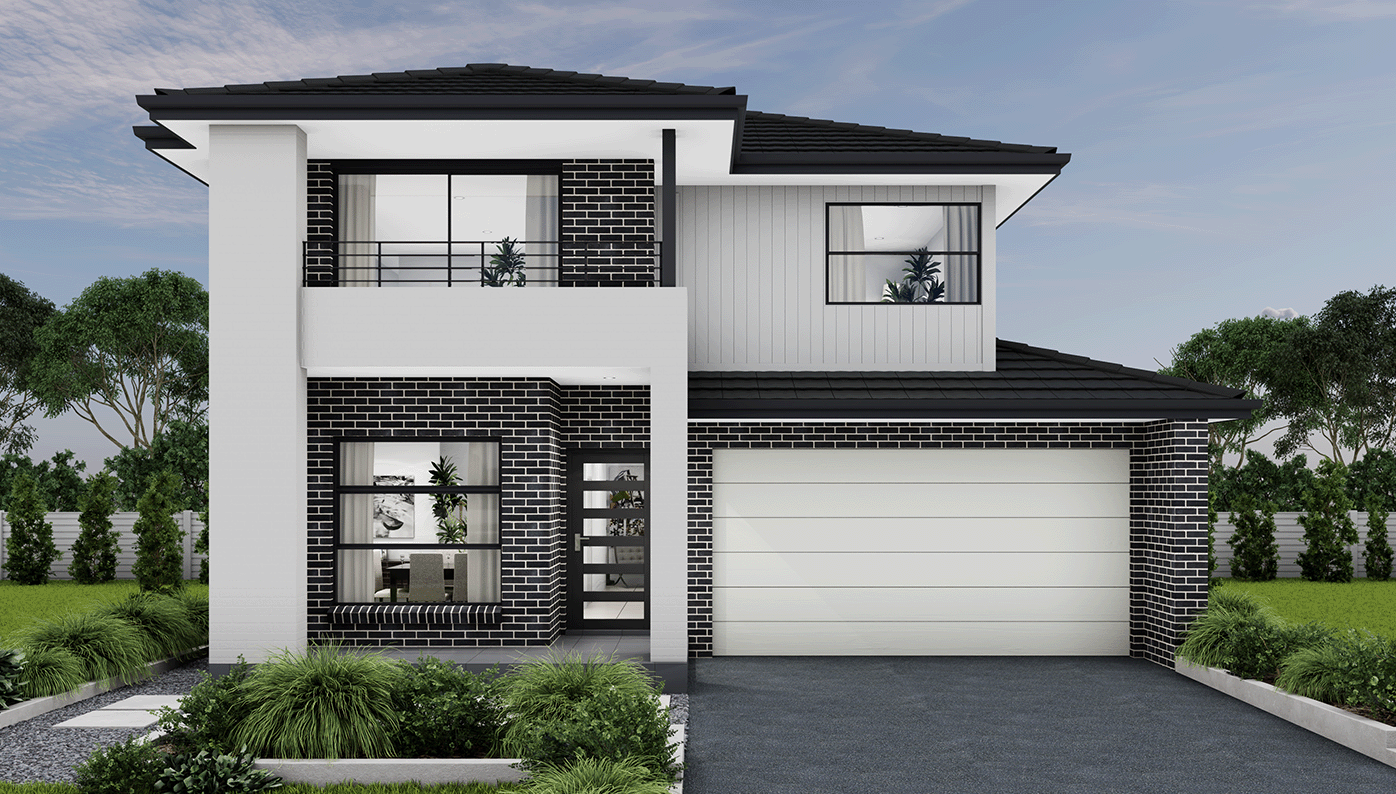

home designs

Explore our range of award-winning home designs made for everyday Australians.

Explore our range of award-winning home designs made for everyday Australians.

Competitive packages, in the hottest locations. What are you waiting for?

Our conveniently located display homes are waiting for you to discover. And our experienced team are ready to help make your new home dreams come true!

See it, love it, buy it! Invest in a premium display home while securing a long-term lease with guaranteed returns.

New Living Homes creates award-winning home designs that don’t compromise on quality. If you're looking for an affordable builder Sydney, Central Coast, Illawarra, Goulburn, Newcastle & The Hunter, then look no further.

We’re constantly coming up with new and innovative concepts to accommodate every type of family and provide promising opportunities for investors. With single storey, double storey, dual living and acreage homes, you're spoilt for choice. We have home that suit 9m lots, right up to 16m+ blocks.

And, as part of The Masterton Group, you get the reassurance of a builder backed by 60 years of strength and stability.

Our house and land packages allow you an easy, affordable, attainable way to find the house you want on the land you need, without jumping through hoops for either. You can make the life you’ve been dreaming of with affordable house and land Sydney packages, Hunter house and land packages, Goulburn house and land packages, and more...

Discover your new home at one of our conveniently located display homes Sydney, Illawarra, South Coast, Central Coast, Newcastle and the Hunter. Our single and double storey display homes provide the perfect platform to experience the design fit for your family.

There is plenty to love about where you live; your street, the schools, the neighbours. You have built your life around this address, and you wouldn't want to move. However, the house is dated, tired, and you long for a new one. You don’t need to compromise on location to get the home of your dreams with a knockdown rebuild.

Have you recently built with us & know someone who’s looking to build? Refer a friend and be rewarded!

You will be spoilt for choice when it comes to what upgrades options you can choose from. And with $40k to spend, it's one shopping spree we know you will enjoy!

With so many designs on the market, it can be overwhelming to choose one as your forever home. But if you’re after a single-storey house that is family-oriented, as well as an entertainer’s dream, we have something great in store for you. The Balmoral 32 is an impressive four-bedroom home that incorporates open-plan living with separate zones to accommodate everyone in the household.